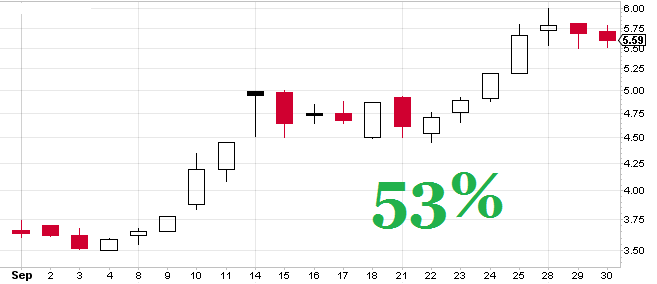

Fig. 1 – Daily Candlestick chart of EDAP. It went up 53% from US$3.64 to $5.59.

STOCKS. The best three stocks in the 1-month category are EDAP @ 53%, HIHO @ 37% and ULBI @ 36%.

A stock trading on NasdaqGM, EDAP belongs to the Healthcare sector, Medical Appliances & Equipment industry. With 161 employees, this company based in France together with its subsidiaries, develops, produces, markets, distributes, and maintains a portfolio of minimally invasive medical devices for the treatment of urological diseases worldwide.

The stock price went up because at the beginning of the month managers presented at a global investment conference, in the middle of the month the company led amongst peers with strong fundamentals, earnings were good, it showed up the ‘New Strong Buy’ stocks list and because at the end of the month the management reported growing momentum for treatment of prostate cancer in Europe.

Three stocks with the biggest 1-month decline are ZINC @ –61%, VNCE @ –62% and MHR-D @ –75%.

The top three stocks in the 3-month category are EDAP @ 72%, SOCB @ 57% and EDUC @ 52%.

In the YTD category, the best three stocks are EGRX @ 377%, REPH @ 320% and EXEL @ 289%.

In the 12-month category, the best three stocks are EGRX @ 485%, ANAC @ 381% and EDAP @ 326%.

In the “What’s hot, what’s not” category, the five hottest stocks are UTSI, UVE, BBSI, GALT and LABL; the five least hot stocks are ZINC, YECO, HCLP, RKDA and TANH.

SECTORS. 67 industry sectors out of 182 are in green territory, an increase from last month.

The top three winners are Transportation – Airline, Outsourcing and Computers – Networks. The three bottom sectors are Internet Commerce, Banks – Major Regional and Medical – Generic Drugs.

MUTUAL FUNDS. The top performers this month are two of the Cushing funds @ 245% – 252%, two of the Profunds Ultrashort Latin America funds @ 21% and two of the Profunds Ultra Short Japan funds @ 14%.

EXCHANGE TRADED FUNDS. The best three ETFs this month are Direxion Daily S&P Biotech Bear @ 58%, Proshares Ultrapro Short Nasdaq @ 43% and Direxion Daily S&P Oil & Gas Ex @ 29%.

FUTURES. The top contracts are: (Currencies) Russian Ruble @ 2.64%, (Energies) Ethanol @ 5.04%, (Financials) T-bond @ 1.80%, (Grains) Rough Rice @ 11.67%, (Indices) DJIA mini-sized @ 1.81%, (Meats) Lean Hogs @ 7.53%, (Metals) Palladium @ 13.95% and (Softs) Sugar @ 10.70%.

INDEXES. The best three indexes are the US Dollar Index @ 1.15%, S&P Utilities Index @ 0.93% and Dow Utilities Index @ 0.81%.

DOW Jones Industrial Average finished down @ –2.15% this month.

*

Relevant in September were titles like: “Ray Dalio: It’s A Depression, Not Recession”, “Big cities scramble to be prepared for an oil train disaster”, “Odds are that a cyclical bear market has begun”, “Leon Cooperman: Why this bull market isn’t over”, “Shell CEO: The World Will Need More Oil”, “The US Will Remain the World’s Reserve Currency”, “IEA sees U.S. oil output collapsing next year on low prices”, “Here’s when economists expect to see the next U.S. recession”, “Oil could plunge to $20 in doomsday scenario, Goldman Sachs says”, “OPEC: The US shale boom is over”, “A Bear Market Is Coming. Here’s What to Expect”, “Robert Shiller: THIS is the sign we’re in a bubble”, “Blockchain technology expected to change financial market: ASIC | ZDNet”, “How the super-rich are investing in current markets”, “No, the Fed is not driving the markets”, “MORGAN STANLEY WARNS: Americans are starting to do ‘dumb things’ with their money”, “The bear market has begun (Sept. 23)”, “The simple reason you’ll probably never retire comfortably”, “What it really means to live within your means”, “Cash flows beat stocks for first time since 1990”, “Bill Gross Says Americans Getting ‘Burned Alive’ by Fed Policy”, “Goldman Sachs cuts forecasts for S&P 500”, “Stocks may be setting up for negative year (Sept. 29)”, “We are in a bear market: Carter Worth”, “Market rides the line between bull and bear”, which are self-explanatory.

E&OE.

Predictions are underlined for future verification.

Leave A Comment