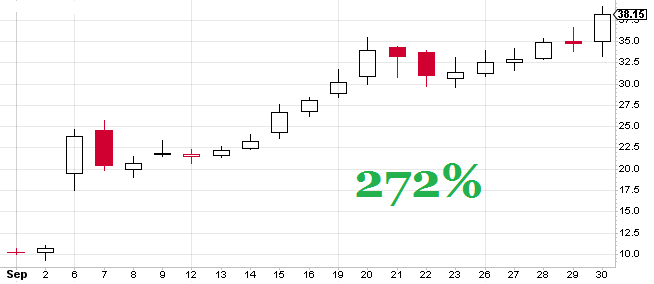

Fig. 1 – Daily Candlestick chart of CLCD. It went up 272% from US$10.25 to $38.15.

September 2016 USA market view

STOCKS. The best three stocks in the 1-month category are CLCD @ 272%, SRPT @ 125% and CRBP @ 65%.

A stock trading on NasdaqGM, CLCD belongs to the Healthcare sector, Biotechnology industry. With 7 employees, this USA company develops small molecules for the treatment of acute migraine.

The stock price went up because of positive data on its migraine drug released at the beginning of the month, it hit 52-week highs, management announced proposed public offering of common stock and pricing for it, its interim updates were good and because it presented a corporate overview at the Ladenburg Thalmann 2016 Healthcare Conference, in New York City in the last week of September.

Three stocks with the biggest 1-month decline are RGSE @ –47%, CXRX @ –50% and GBSN @ –86%.

The top three stocks in the 3-month category are REN @ 777%, CLCD @ 367% and SRPT @ 222%.

The top three stocks in the YTD category are REN @ 499%, AXU @ 423% and CDE @ 377%.

In the 12-month category, the best three stocks are REN @ 1,236%, CLCD @ 886% and ERII @ 647%.

In the “All time Highs” category the best three stocks are CLCD, MRUS and GWPH.

SECTORS. 97 industry sectors out of 182 are in green territory, a drop from last month.

The top three winners are Transportation – Airline, Medical Services and Oil – US Exploration and Production. The bottom three sectors are Beverages – Soft, Large Cap Pharma and Movie & TV Production and Distribution.

MUTUAL FUNDS. The top performers this month are four of the Eventide Healthcare & Life Sciences Fd @ 10%, Vantagepoint Broad Market Index Fd T Shst and Kayne Anderson Midstream Energy Fund Inc. @ 8% and Tortoise Pipeline & Energy Fund Inc. @ 7%.

EXCHANGE TRADED FUNDS. The best three ETFs this month are DB Commodity Long ETN Powershares @ 52%, Ipath Long Bond Bear @ 27% and Direxion Daily S&PBiotech Bull @ 26%.

FUTURES. The top contracts are: (Currencies) South African Rand @ 7.37%, (Energies) Gasoline @ 12.28%, (Financials) 10-year T-note @ 0.27%, (Grains) Wheat @ 4.58%, (Indices) S&p GSCI @ 1.61%, (Meats) Live Cattle @ –8.37%, (Metals) Palladium @ 7.22% and (Softs) Sugar @ 9.53%.

INDEXES. The best three indexes are CBOE Volatility Index @ 16.19%, S&P GSCI Index @ 5.22% and PHLX Semiconductor Index @ 4.18%.

DOW Jones Industrial Average finished down @ –0.79% this month.

*

Relevant in September were titles like: “Traders are loading up bets on a market outcome that should make everyone nervous”, “I can quadruple my money by betting on this airline: Trader”, “One more bull leg, but short-term pain first: analyst“, “There’s a successful hedge fund strategy that’s bucking the $34 billion outflows”, “Top Oil Trader Says Oil Is In For A ‘Violent Reversal’ (Sept. 2)“, “The Fed may be preparing for the unthinkable – negative interest rates in America”, “These are the signs of an economic collapse”, “The SEC has as a double standard when it comes to insider trading”, “The Coming Storm for Global Financial Markets”, “Barron’s: Federal Deficit Is Set ‘to Explode'”, “Something rare is happening in the market with the VIX: Trader”, “120 years of history point to a September slide for stocks”, “People are almost completely ignoring a looming crisis for oil”, “Morgan Stanley Predicts S&P 500 to Hit 3,000 After 2018 Downturn“, “A correction is coming, and nothing can stop it, this economist says”, “Crude hits $40 before it heads higher: Pro”, “3 Questions To Find Your Trading Plan”, which are self-explanatory.

E&OE.

Predictions are underlined for future verification.

Leave A Comment