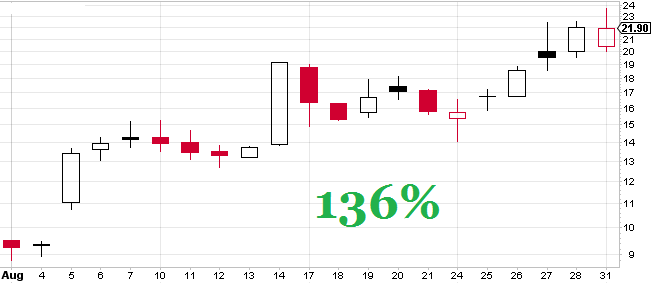

Fig. 1 – Daily Candlestick chart of EFOI. It went up 136% from US$9.26 to $21.90.

STOCKS. The best three stocks in the 1-month category are EFOI @ 136%, AXGN @ 38% and NDRM @ 35%.

A stock trading on NasdaqCM, EFOI belongs to the Consumer Goods sector, Home Furnishings & Fixtures industry. With 77 employees, this Ohio, USA-based energy company designs, develops, manufactures, markets, and installs energy-efficient lighting systems and solutions throughout USA and internationally.

The stock price went up because the second quarter 2015 reports were good, the financials filed in mid August were strong, construction stocks remained hot creating solid demand for products which the company manufactures, because Cleveland Clinic selected the company’s tubular LED technology for its usage and the stock jumped 9.3%, because it led among peers with strong fundamentals and Zacks Investment included the company in its Ideas Feature Highlights.

Three stocks with the biggest 1-month decline are CLNT @ –46%, RCAP @ –65% and AAMC @ –71%.

The top three stocks in the 3-month category are EFOI @ 240%, LPCN @ 109% and CARA @ 99%.

In the YTD category, the best three stocks are EGRX @ 406%, REPH @ 369% and DSKX @ 351%.

In the 12-month category, the best three stocks are EGRX @ 527%, ANAC @ 475% and EFOI @ 376%.

In the “What’s hot, what’s not” category, the five hottest stocks are EOX, LEI, REXX, AXPW and MDCO; the five least hot stocks are SRNE, ANTH, VHI, ANIP and CFMS.

SECTORS. 19 industry sectors out of 182 are in green territory, a decrease from last month.

The top three winners are Computer – Networks, Lasers – System & Components and EFTs – Precious Metals. The three bottom sectors are Beverages – Alcohol, Protection – Safety and Internet – Software.

MUTUAL FUNDS. The top performers this month are five of the Pimco Stocksplus Ar Short Strategy Fund funds @ 419% – 421%, two of the Ls Theta Fund Investor Class funds @ 392% and five of the Pimco Fundamental Advantage Absolute Ret funds @ 196%.

EXCHANGE TRADED FUNDS. The best three ETFs this month are Ultra VIX Short-Term Fut ETF Proshares and Daily 2X VIX ST ETN Velocityshares @ 159%, C-Tracks Citi Volatility Index TR ETN @ 91% and two of the VIX Short-Term Futures funds @ 67%.

FUTURES. The top contracts are: (Currencies) Japanese Yen @ 2.93%, (Energies) ULSD NY Harbor @ 3.11%, (Financials) 10-year T-note @ 0.42%, (Grains) Rough Rice @ 3.01%, (Indices) CBOE S&P500 VIX @ 84.34%, (Meats) Lean Hogs @ 6.75%, (Metals) Gold @ 4.29% and (Softs) Orange Juice @ 3.45%.

INDEXES. The best three indexes are CBOE Volatility Index @ 134.57%, S&P GSCI Index @ 0.65% and US Dollar Index @ –1.40%.

DOW Jones Industrial Average finished down @ –6.57% this month.

*

Relevant in August were titles like: “Puerto Rico agency misses payment in first default”, “Jimmy Carter Is Correct that the U.S. Is No Longer a Democracy”, “U.S. Companies Are Dying Faster Than Ever”, “GRANTHAM: We could be headed for a ‘very different’ type of crash in 2016”, “Stocks are a ‘disaster waiting to happen’: Stockman”, “This is the ‘biggest fear’ for markets: Expert”, “The Bankruptcy Of The Planet Accelerates – 24 Nations Are Currently Facing A Debt Crisis”, “Could you be replaced by a robot at work?”, “Oil collapse couldn’t come at worse time for industry”, “Norway: $50 Oil Is Worse Than the Global Financial Crisis”, “WARREN BUFFETT: Stocks are going ‘a lot higher’”, “People are buying second homes on cruise ships”, “Oil headed to $30: Kilduff”, “GUNDLACH: If oil goes to $40 a barrel something is ‘very, very wrong with the world'”, “OPEC just kicked oil into the $30s”, “Dow death cross is a bearish omen for the stock market (Aug. 12)”, “$30 oil coming sooner than you think: Kilduff”, “The Fed is on thinner ice than it realizes, may be setting us up for recession”, “Gold is Crashing! No, Wait, it’s Booming! So What’s Really Going on With Gold?”, “Here’s Why Supply and Demand Means $30 Oil”, “Why oil may not get the cure it needs”, “This is the market you’ve been wishing for”, “Cheer up, gold bugs: HSBC predicts a year-end recovery”, “Energy Stocks Have ‘Big’ Upside Potential: Parker”, “An Oil Price Spike Could Be Nearer Than You Think”, “Hedge Fund Fees: The Rorschach Test of Investing”, “Oil Prices Must Rebound. Here’s Why”, “Oil could hit $65 by year end: Analyst”, “Stock market endures worst day in 18 months (Aug. 20)”, “S&P 500 slump could be biggest bull signal of all”, “TOM LEE: Here’s the most important reason to still believe in the bull market”, “China fears hand Wall St. its worst day since 2011 (Aug. 21)”, “Disappointing business surveys intensify world growth fears”, “Market correction not over yet: Bob Doll”, “Gold below multi-week highs; PGMs tumble on equities rout”, “Why stocks are tumbling 6 years into the bull market”, “El-Erian: Stocks have a lot lower to go from here”, “Dow 5,000? Yes, it could happen”, “Expect markets to fall 20 to 40 percent: Marc Faber”, “U.S. short on options to confront next crisis”, “’Death of cash’ predicted within a decade”, “Not so fast. Oil may test $30 again: Trader”, “Wall Street drops more than 6% in worst month since ’12”, which are self-explanatory.

E&OE.

Leave A Comment